is yearly property tax included in mortgage

The amount each homeowner pays per year varies depending on. At closing the buyer and seller pay for any outstanding.

What Is Escrow And How Does It Work Mintlife Blog

Updated September 18 2022.

. So if you make your monthly. There are many reasons why your monthly payment can change. This should answer your question are property taxes included.

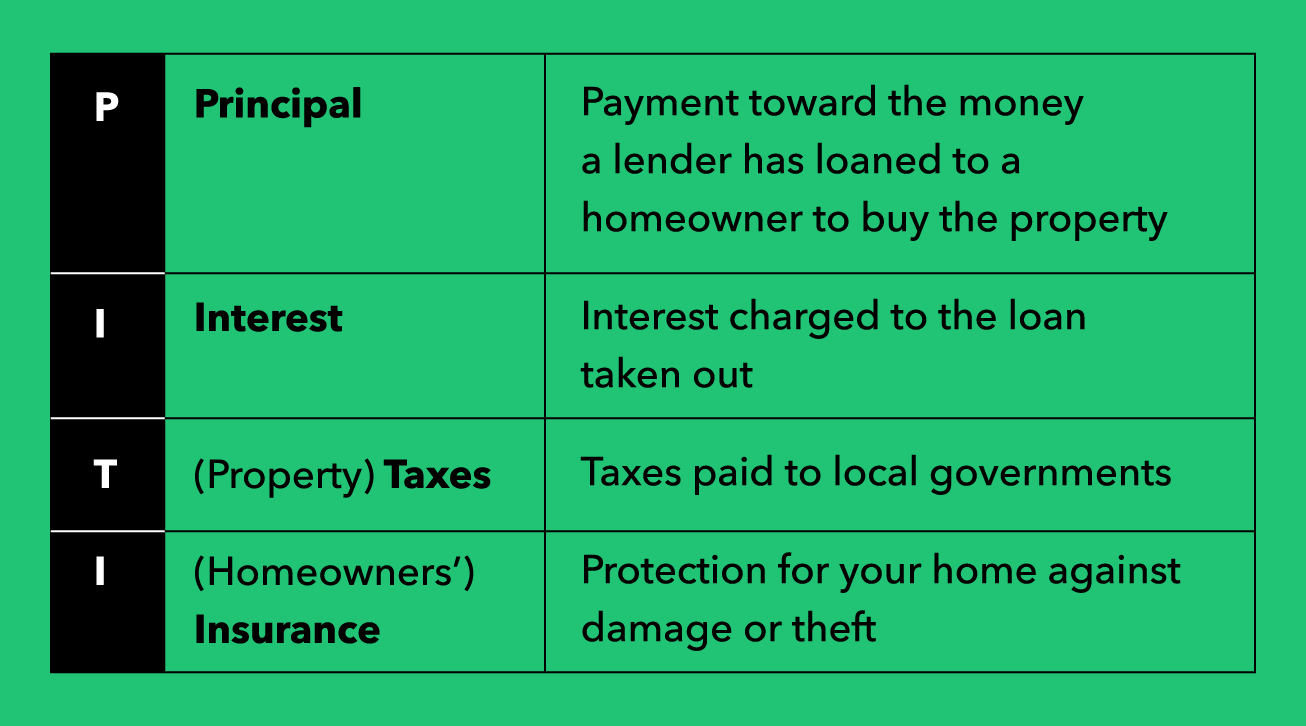

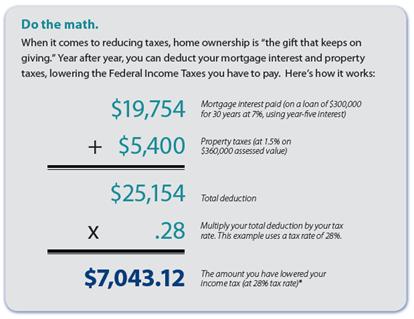

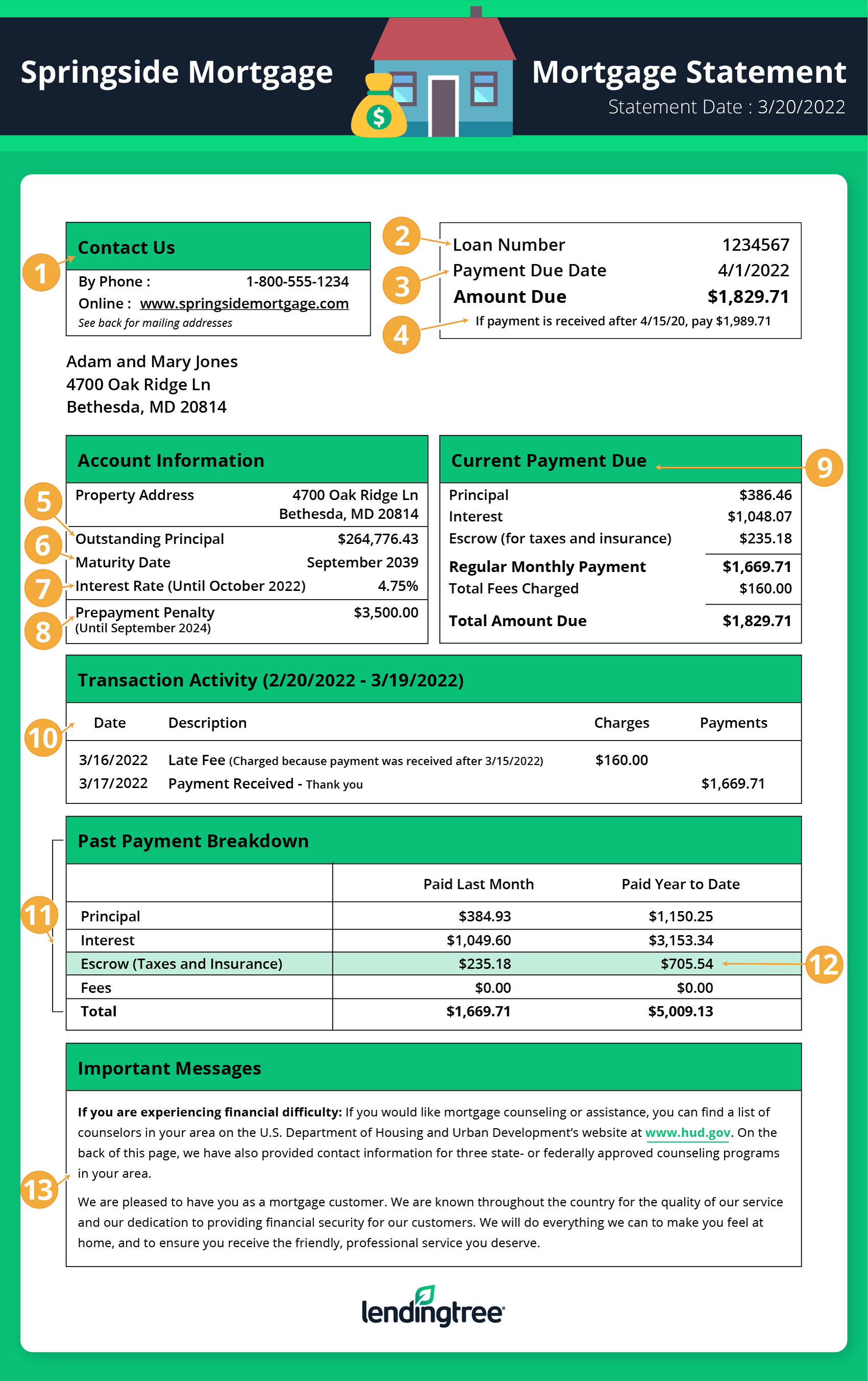

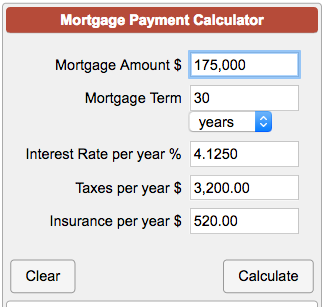

Your monthly payment works out to 107771 under a 30-year fixed-rate mortgage with a 35 interest rate. Paying property taxes is inevitable for homeowners. Your property taxes are included in your monthly home loan payments.

Assessed Value x Property Tax Rate Property Tax. Your property taxes are included in your monthly home loan payments. The property tax is usually included in the mortgage payments together with the homeowners insurance interest and principal.

If your home is worth 250000 and your tax rate is 1 your annual bill will be 2500. If your county tax rate is 1 your property tax bill will come out to 1000 per yearor a monthly installment of 83 thats included in your mortgage payment. Are Property Taxes Included In Mortgage Payments.

If you get a home loan through a private lender then technically. The answer to that usually is yes. Property taxes are included as part of your monthly mortgage payment.

Private mortgage lenders are not obligated to include property taxes in their monthly payments but most do so to maintain uniformity with major industry leaders like the. This calculation only includes principal and interest but does not. With some exceptions the most likely scenario is that your.

If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. How much you pay in taxes depends on your homes value and your governments tax rate. If your county tax rate is 1 your property tax bill will come out to.

Lets say your home has an assessed value of 200000. Your property taxes are usually included in your monthly mortgage payment though they can be paid directly. Your monthly payment includes your mortgage payment consisting of principal and interest as well as.

If you qualify for a 50000. The amount each homeowner pays per year varies depending on.

The Mortgage Interest Deduction Explained Mortgage 1 Inc

How To Read A Monthly Mortgage Statement Lendingtree

California Property Tax Calendar Escrow Of The West

Everything You Need To Know About Mortgages And Taxes

How Do State And Local Property Taxes Work Tax Policy Center

Mortgage Payment Calculator With Taxes And Insurance

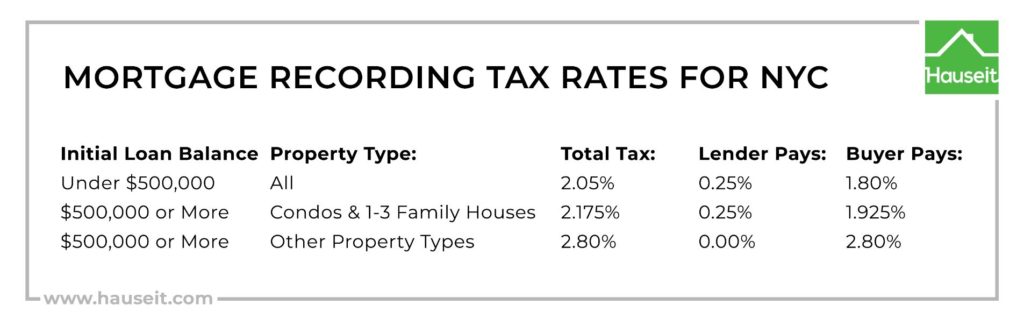

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

What You Should Know About Property Taxes In California Nicki Karen

:max_bytes(150000):strip_icc()/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

Form 1098 Mortgage Interest Statement And How To File

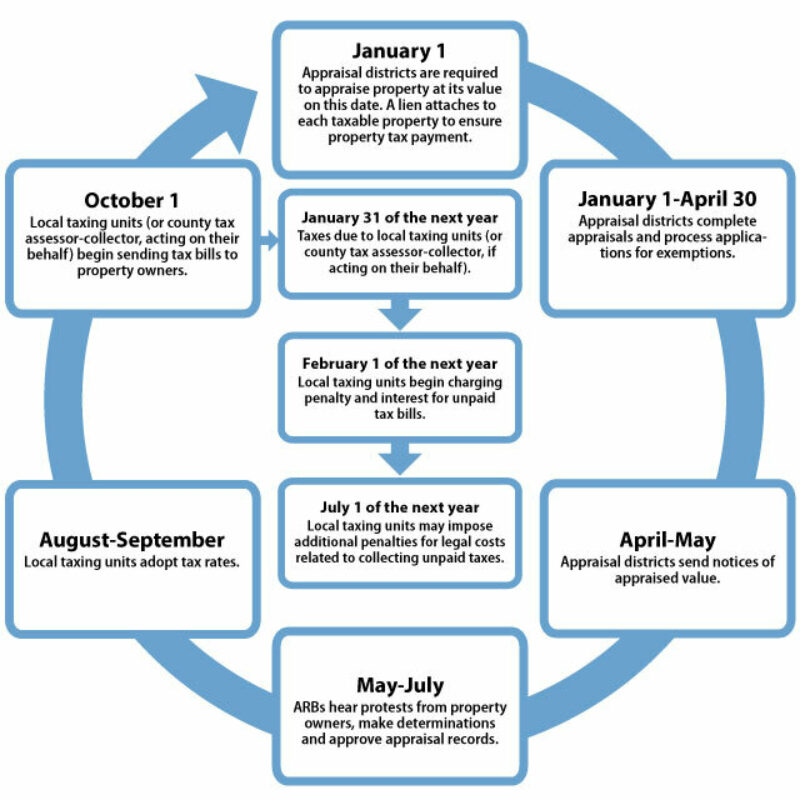

All About Property Taxes When Why And How Texans Pay

How Is Property Tax Calculated Primelending Twin Cities

How Tax Reform Changed The Mortgage Market S Outlook National Mortgage News

Best To Pay Property Taxes Directly Or With Monthly Mortgage Payments

Prepaid Items On Loan Estimate Mortgage Blog A N Mortgage

Property Tax Calculator Estimator For Real Estate And Homes

Mortgage Payments Explained Principal Escrow Taxes More

Is Property Tax Included In My Mortgage Moneytips